Friday, December 31, 2010

My Story – Part I

I haven’t written for awhile because I have been struggling with the notion that financially I have made quite a few mistakes and felt like I had NO business giving financial advice to others. I knew all the right things to do and didn’t do them. Recently, I realized now is the perfect time to write a financial blog. I am going through the same financial things everyone else is. So I am going to tell my story, share my successes and failures, and pass along any helpful financial advice I come across during my own journey towards financial independence.

So, how did my GF and I get into this mess?

Like I said my GF has been pretty sick the past year (we chronicled our journey here) but really this is an excuse that we have been using. The whole time she was off work she was still receiving a pay check. During her illness insurance paid for the surgery and radiation (which was good because the radiation treatments were more than $70,000 in total, I believe), so we weren’t out much money there. Our problem was simply spending beyond our means. We took a vacation – much deserved but not responsible considering our situation, ate out a lot (she lost her sense of taste so a lot of money was spent trying to find food she could eat. This could have been handled much better but I figured she was suffering enough without living on protein shakes only), lots of new clothes, and the new vehicle. I felt a lot of pressure and guilt, I couldn’t say no to her because of what she was going through. Saying no is a huge issues for me personally and financially and is something through this journey that I MUST work on to be successful.

Not staying true to my financial beliefs ended in financial disaster. I’m a pleaser and this gets me into trouble a lot, I give whatever I have to those who need it and in many cases to people who simply want it. This never works out well for me because as the old saying goes “give a man a fish and he eats for a day, teach him to fish and he eats for a lifetime”, or something like that. I have realized my biggest problem is saying no and in order to reach my own financial independence I HAVE to say no to others if what they want stands in the way of my journey.

I, also, allow myself get caught up in the excitement of the purchase since I grew up not having or getting much and spend a lot of time trying to make up for what I didn’t have. These are very bad traits to have when buying something as life changing a vehicle. I say life changing because before this purchase I didn’t have a vehicle, no I had no car payments nor insurance payments to be responsible for. We needed a new vehicle and spent a lot of time trying to figure out what type of vehicle we wanted – a great thing to do. But then we went out to look at the vehicles in person and fell in love with a 2003 Range Rover. Crazy! This is where we got real stupid…we ended up buying a vehicle that we were totally unprepared for, but really wanted. The insurance, gas, and maintenance are way more than we bargained for. Basically we didn’t think the purchase through enough because we got caught up in the vehicle and the sales men talked a real good game. We both loved our vehicle despite it all for whatever demented reason.

One major financial issue we faced was our different philosophies. She’s a spender, I’m a saver. I never realized how much money can affect a relationship until now. It has been a HUGE struggle at times to get on the same page, but I think we are finally there. It took a lot of tough conversations (read arguments) and setting goals for the future, together for us to get where we are actually facing our bad decisions and to be ready to move forward in a positive direction. Those tough conversations lead to developing a plan:

1. We developed a budget. We budgeted for monthly expenses (rent, cable, phone, gas, student loans, etc.) for debt repayment, savings (house, vacations, wedding), and for fun money (we signed up for online coupons through Groupon and Living Social to help our fun money go even further and try to find cheap and free things to do).

2. We have separated our money to help better learn to manage finances. Before separating our finances, we had a joint account where all the money went and all the bills were paid from. We both had separate accounts that rarely had money because of our poor spending habits. A lot of arguments revolved around the lack of individual money but once we sat down and really looked at the spending we never had individual money because we spent it before it even got there. In the beginning of our relationship I was given total control of the finances; I hated it and she regretted it. Now, my pay check goes to my account and hers to her account. We sit down and calculate how much needs to go to joint bills and that amount goes to the joint account. I am responsible for paying certain joint bills, she for others. Personal bills we are each responsible for our own. This allows her to learn to manager her money and for me to learn to give up control. So far, it seems to be working.

3. We have downgraded our cable and internet (cut the home phone), downgraded our cell phone plans, we are downsizing and decluttering our lives and trying to cook more.

4. We developed a plan to get out of debt and to save for the future. It won’t be easy but if we work together and keep our eye on the things that REALLY matter to us, we will be completely financially independent in a matter of years. (Years seem so long, but let’s face it getting out of debt takes time.)

We keep each other on track and motivated when things get tough and I will do the same for my Life’s Freefall readers. Don’t be scarred to admit you aren’t financially where you want to be or to admit you have made mistakes along the way. We all do it. Start changing your behaviors and we will all be financially independent in no time!

Thursday, November 25, 2010

NYP in Action for the Community Party for Senior Citizens 2010

By second-year Diploma in Molecular Biology Student Tan Kiat Yi.

They came, sang and danced and played games - more than 480 senior citizens from nine constituencies had a fun-filled day at special party at Nanyang Polytechnic (NYP). The party held on Saturday 23 October was jointly organized with the Lions Befrienders Service Association as part of “NYP in Action for the Community” initiative. The initiative aims to raise awareness of community involvement among NYP’s staff and students, as well as inculcate in them a spirit of care and giving to the community at large.

NYP’s School of Chemical & Life Sciences took the lead this year with the help of 63 staff and 216 students from across NYP.

The party started at 9 am when busloads of senior citizens arrived from all over Singapore. They received a grand welcome as students lined the canteen clapping and cheering as they proceeded to their seats. They each received a goodie bag containing a bottle of water, biscuits, packs of tissue and a foldable fan.

Highlights of the day included the following games:

- “Guess the Song” where participants had to guess the title of songs based on a song snippet.

- “Jigsaw Puzzle”, where seniors had to work together in groups to solve challenging jigsaw puzzle.

- “Musical Beach Ball” a modified version of musical chairs, where instead of chairs, a beach ball was passed around.

The real fun, however, began when some seniors went up on stage to sing all-time favorite hits such as “The moon represents my heart” by Teresa Teng. Many of them were deeply immersed in the music, going up on stage for solos and duets. Some of them even went on stage to dance the Macarena! They were also treated to songs sung by Dr Joel Lee, Director of the School of Chemical and Life Sciences (SCL (LS)), Dr Lee’s effort garnered much applause.

It was a fun-filled day with activities and entertainment for all participants, and they left with smiles on their faces.

Tuesday, November 23, 2010

Awakening Experience in Cambodia

Thursday, September 30, 2010

Youth Olympic Games: An Awesome Opening Ceremony

Stacey, who was covering the YOG opening ceremony as a young journalist, shares her experience.

The massive scale of the event only began to dawn on us as we sat in the media section, located at the highest level of the seating gallery against a backdrop of the flags of all 204 participating countries. We watched in awe as journalists, photographers and cameramen from all over the world streamed past us. We admired their equipment, feeling like we had yet to earn our stripes in order to sit with them. It was really an international gathering! Thais sat beside Canadians while Germans chatted excitedly to each other as the Brazilians near them rummaged through their goodie bags. A cacophony of voices with accents from all five continents surrounded us, and left us feeling like we had travelled overseas.

Clocking in at an estimated two and a half hours, Singapore’s version of the Olympic opening ceremony kicked off with a performance by Malay, Chinese, Indian and Eurasian participants. This introduced Singapore’s multi-cultural society to an estimated 2 billion viewers around the world to. For me, that segment was reminiscent of National Day Parade performances, where messages of racial harmony are de rigueur. But when I considered that the world was seeing, for the first time, what Singaporeans have always enjoyed every year, I began to appreciate it in a whole new light.

The next segment, titled ‘Origins’, took the audience through a brief recap of Singapore’s journey from past to present. As a Singaporean, I was thrilled to see our nation’s story being told on such a platform, with the world watching. Singapore does have a lot of achievements to be proud of, built on the hard work and determination of our ancestors, and I was glad that as host city of the YOG, we had been given a chance to let the world know how far we have come.

The rest of the ceremony was laden with symbolism, with segments about what motivates the young Olympians to strive for excellence, and how they overcome insecurities and fears to do their best in the face of competition. There was even a segment titled ‘S.O.S.’ that called for the world to work together to address global problems such as war and natural disasters. Each segment was kept short and sweet, hardly exceeding 10 minutes each. It made the ceremony feel like a fast-paced movie with spectacular special effects such as laser shows and generous fireworks displays at the end of each segment.

The next highlight was the parade of flags of all participating countries. Marcus, Rebecca and I waited impatiently for Singapore’s flag to enter. As we waited, the audience members took turns to cheer themselves hoarse when their nation’s flag was paraded. The excitement and sense of anticipation around us was incredible. A large group of Belgians were seated in front of us, and all of them stood up in a great show of support for their country, yelling, clapping and waving miniature Olympic flags when the Belgian flag made its appearance. As host nation of the YOG, Singapore’s flag was the last to enter, and I do not think I am being biased by saying that it received the longest and loudest cheers. It was my first time cheering for my country along with such an enormous audience, and it warmed my heart to see that it was not just the Singaporeans who stood up for Singapore’s flag. In fact, the majority of the people around us stood up to applaud. How fantastic it was to watch the foreign journalists that my classmates and I had admired earlier cheering for Singapore!

If I had to name my favourite part of the ceremony, it would have to be the culmination of the YOG torch relay. The flame was brought to the Marina Bay floating platform on a giant phoenix vessel built to carry the torchbearer across Marina Bay. The phoenix was beautifully lit up and everyone watched in awe as it cruised across the Singapore River towards the floating platform, looking like a fabled creature from an ancient legend. The grandiosity of it all was not lost on the audience, and we heard plenty of stunned gasps and exclamations of delight at the sight of the phoenix.

The torch relay continued, with several torchbearers passing the flame, as they made their way to the floating platform. The last torch-bearer, 16-year-old sailor Darren Choy, ran across the reflective pool behind the main stage to light the YOG cauldron, which was housed in a lighthouse structure. When the Flame touched the base of the structure, it travelled impressively up the lighthouse in a column of fire, spiralling upwards and quickly reaching the top where it was greeted by tremendous applause from a dazzled audience. I clapped enthusiastically too, overwhelmed by the sensational finale.

Having attended the YOG opening ceremony as part of the media team from Nanyang Polytechnic, I am honoured to have had the chance to witness this historic event. The experience has given me a taste of what it is like to view events like this through the eyes of someone who works in the media industry, and has allowed me to rub shoulders with accredited journalists all over the world. I look forward to more of such opportunities in future, and hope that I will never let myself become jaded or take these opportunities for granted!

Friday, September 24, 2010

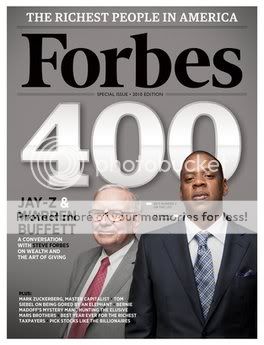

What Happens When Some of the Richest Men in the U.S. Get Together?

Warren Buffett, Jay-Z, and Steve Forbes recently sat down for a discussion. What else could they talk about besides money? The 3 have very little in common besides being brilliant business men and being rich.

The 3 sat down for an hour long conversation on “the power of luck”, the music business, and success and giving among other things. Take a look...

Tips on Getting Rich From a RICH Man

According to his Wikipedia page:

Warren Edward Buffett is an American investor, industrialist and philanthropist. He is one of the most successful investors in the world. Often called the "legendary investor Warren Buffett", he is the primary shareholder, chairman and CEO of Berkshire Hathaway. He is consistently ranked among the world's wealthiest people, he was ranked as the world's second wealthiest person in 2009 and is currently the third wealthiest person in the world as of 2010.

Buffett is called the "Oracle of Omaha" or the "Sage of Omaha" and is noted for his adherence to the value investing philosophy and for his personal frugality despite his immense wealth. Buffett is also a notable philanthropist, having pledged to give away 99 percent of his fortune to philanthropic causes, primarily via the Gates Foundation. He also serves as a member of the board of trustees at Grinnell College.

So now you know why the man is mentioned so often in finance circles. I don’t really quite know “what I want to be when I grow up” but I know I want to follow in his footsteps. I have a long way to go. Maybe if we follow his tips we can have a piece of what he has.

Fivecentnickle has nicely laid Buffett’s tips out for us:

1. Reinvest your profits. When you make money, reinvest your profits instead of spending them. Even a small sum can ultimately be turned into great wealth.

2. Be willing to be different. Don’t base your decisions on what everyone else is saying or doing. Think for yourself if you want to be above average.

3. Never suck your thumb. Do your homework, and be prepared to quickly make up your mind and act on it. Avoid unnecessary sitting and thinking.

4. Spell out the deal before you start. Your leverage is always greatest before you begin a job. Always work out the specifics of a deal before you start, even if you’re dealing with friends or family.

5. Watch small expenses. Be vigilant about minimizing your expenses, both in business and in your personal life. By doing so, you’ll ensure that you profits or paycheck go further than ever before.

6. Limit what you borrow. You can’t borrow your way to wealth, so be careful with loans and credit cards. And if you get in over your head, negotiate with your lenders to pay what you can. Once you’re debt free, save money and start investing.

7. Be persistent. With tenacity and ingenuity, you can win against a more established competitor.

8. Know when to quit. Know when to walk away from a losing proposition. There’s no sense in repeating the same old mistakes trying to dig yourself out of a hole.

9. Assess the risks. When faced with a decision, imagine the best- and worst-case scenarios. If the benefits don’t outweigh the risks, then think twice before proceeding.

10. Know what success really means. There’s more to life than money. According to Buffett, “When you get to my age, you’ll measure your success in life by how many of the people you want to have love you actually do love you. That’s the ultimate test of how you’ve lived your life.”

A lot can be learned about how to manage money from millionaires, after all they weren’t always rich (most of them anyway). So, Mr. Buffett, I salute you!

Thursday, September 16, 2010

I Wish I Knew Then What I Know Now

My piggy bank.

I can’t help but think, “I wish someone would have told me about…” when I was growing up.

My dad's piggy bank. hahaha

Growing up I did have the normal babysitting, paper routes, lawn mowing jobs but I was never able to save the money past putting it in my pocket. Once I hit high school my mom did open a checking and savings account for me, but money never seemed to stay there long either. In college, my checking account was set up so I had to keep $500 in it at all times, which was a good lesson in building up my account.

I received my first credit card in college and didn’t know what to do with it or how to use it. I charged lots of dumb things on it that took a LONG time to pay off. I bought a Playstation on credit and it took me almost 2 years to pay off. I didn’t learn my lesson though. I kept charging and kept owing because, well, that what my parents had done.

Knowing what I know now, the blueprint set out by my parents had me designed to repeat their bad money habits and not to succeed financially. Some things like having a set limit in my checking account that I don’t let my account fall below is great but everything else I learned the hard way and on my own.

If I knew then what I know now about savings, credit cards, loans, and investing I would have a lot more money in my pocket and would be paying less of my hard earned money to everyone else.

What did I learn from my parents?

Well, I learned not to purchase anything on credit that I can’t pay for outright (still working on this one). I learned to sacrifice things I want for things I need. I learned that after 7 years your credit history is cleared, even though my parents still blame each other for their current financial mess some 18 years after getting divorced. I learned the value of hard work and when to ask for help.

What didn’t I learn from my parents?

Basically everything important. I didn’t learn the power of compound interest. I didn’t learn how to budget. I didn’t learn the importance of using credit correctly. I didn’t learn that I should have found other ways to pay for undergrad and grad school because now Sallie Mae owns me. I didn’t learn how the value of my credit, my dad always told me that all I have is my name (my honor) and my credit. He would say, so don’t let anyone mess them up. I didn’t learn not to put utilities, credit, cell phones in my name for other people (I got burned a couple times on this one, but in my defense the people were family so I figured I would be ok, WRONG). I didn’t learn about retirement planning because my mom feels it’s a waste, but I plan on retiring so I need to plan.

What are some of the things you wish someone would have told you growing up about money and finances?

What are some of the things that someone DID share with you that helped you learn how to handle your money?

Thursday, September 2, 2010

Does Money Equal Happiness?

Money is the root of all evil, or so the saying goes. But is it?

We need money to survive. Everything costs. Even if we don’t physically have the money in hand, we still spend it. Everyone knows, those with money are better and those without money are bad…well that’s the thinking, right?

So, does money equal happiness?

This question has a complicated answer, but the short answer is yes, I think it does. Maybe not in the way you’re thinking…

I was having a discussion last night, when the person I was talking to said to me “I think you would be happier if you just had more money.” I didn’t know how to respond. Sure, I would be happy if I had more money, but I would be happy because my bills would be paid and my family taken care of. Not because I could have tons of stuff. I don’t need stuff, I do, however, need to know my family is taken care of.

Being financially comfortable to me is ideal, that’s what I’m shooting for. Knowing needs are met makes me happy. This doesn’t mean I need a lot of money, it just means I need enough money to do what I need to do.

Greed and happiness are 2 different things. Greed, to me, is the opposite of happiness. Greed is all consuming and ugly. Happiness is, well, happy. It’s light and fluffy and shiny and good. Those who need millions of dollars or lots of things can’t be happy; they are too consumed with stuff. And I would bet they aren’t even happy with all the stuff they have, it’s just stuff at the end of the day.

Money often goes hand in hand with stress. But most times money leads to stress because we don’t have enough to do what we need. So in that case, having more money would be good and take some stress away, hopefully making you happier because you have less stress. Money can also be stressful if you are in a constant chase for more than you need.

Can someone be happy without money? To this, I also answer yes. There are populations of people who have given up worldly treasures, such as money, and they are happier than they could have ever dreamt. Is this because they don’t have to worry about money or because they are now free to focus on things more important than being consumed with money? Probably a bit of both, but more of the latter.

Money can lead to happiness, and unhappiness just as easy. Next time you think your life would be easier if you could just hit the lotto, try to change your thinking. Focus on what you have and what you need, truly need. Think of ways to get you were you need to be and what would make your life comfortable, you don’t need much more than that.

So yes, money can lead to happiness if the powers of money are used for good, not evil. And remember...

Friday, August 27, 2010

Negotiation is fun!

When I sat down and really took a look at my monthly bills, I realized I was paying way too much for some services. Some of these services I didn’t even need. I was paying for 3 cell phones AND a home phone. What did I need a home phone for? I didn’t! I was paying for premium cable channels that I don’t even watch like Showtime. I was still paying for the same cable/phone/internet bundle I had signed up for 2 years earlier that was no longer costing me $99 a month, now I was paying $200 a month. All 3 of my cell phone plans were way too much, in total I was paying $260 or more a month for cell service. I was paying all this extra money because I was too lazy to try to get them lowered.

After looking at my bills, I decided I was going to take a day and get these bills lowered. First, I decided to tackle the cable/home phone/internet with Comcast. I figured it would be easier to contact them using the online chat feature they now have. I started the chat by saying that I love my Comcast service and would hate to switch because I could get a better rate someplace else. I told them I needed to make some changes to my service and would like to cancel my home phone. They told me I would have to call Comcast to shut off a service, so then I moved on to lowering my cable and internet prices. It was pretty easy actually. I told them what I wanted, which was a lower bill, and asked what they could do for me. The representative gave me a couple options, but held out the big guns in case I refused those. I refused. He then offered me what I was already getting, minus Showtime, add free HBO for a year AND faster internet for $99 a month. I agreed to this offer and told him not to do anything with the phone. After turning off my home phone, I saved myself over $100 a month by taking 30 minutes out of my Saturday to ask.

Next, I moved to At&t and T-Mobile. At&t was easy, this is my mother’s cell phone and she only uses the phone for calls to me. I took all the cool stuff off of her service and left her with as few minutes as possible, lowering the bill to $50 a month from the $100 it was. Saved another $50.

Then to T-Mobile. I have a Family plan with T-Mobile with 2 phones. I was paying over $200 a month. T-Mobile also has the chat feature, so I started a chat with a representative. Again, I told them how much I love their services and that I am looking to lower my month bill. I had everything, unlimited everything and MyFavs. For me, I don’t even use many minutes or the MyFavs because I’m a texter not a talker. I cut the MyFavs and went from unlimited minutes to 1500 minutes Even More plan. This is a gamble because my partner is a talker. Essentially she gets most of the 1500 minutes, so everything should be cool. We are now down to about $150 a month. Saving another $50.

All together I saved myself $200 a month just by asking.

There are many other places you can negotiate for a lower price. I have negotiated hundreds off of the price of furniture, new tires, carpet cleaning, hotel rooms, debts all sorts of things. I always ask if there is a discount and there usually is.

I haven’t tried to negotiate my credit card interest rate yet, but that’s next.

I have found using these tips are a good way to save yourself some money each month. Mindtools.com lists these tips to use when negotiating:

• Goals: what do you want to get out of the negotiation? What do you think the other person wants?

• Trades: What do you and the other person have that you can trade? What do you each have that the other wants? What are you each comfortable giving away?

• Alternatives: if you don’t reach agreement with the other person, what alternatives do you have? Are these good or bad? How much does it matter if you do not reach agreement? Does failure to reach an agreement cut you out of future opportunities? And what alternatives might the other person have?

• Relationships: what is the history of the relationship? Could or should this history impact the negotiation? Will there be any hidden issues that may influence the negotiation? How will you handle these?

• Expected outcomes: what outcome will people be expecting from this negotiation? What has the outcome been in the past, and what precedents have been set?

• The consequences: what are the consequences for you of winning or losing this negotiation? What are the consequences for the other person?

• Power: who has what power in the relationship? Who controls resources? Who stands to lose the most if agreement isn’t reached? What power does the other person have to deliver what you hope for?

• Possible solutions: based on all of the considerations, what possible compromises might there be?

Go give it a try, all they can say is no…

p.s. I thought this was funny…

A: Excuse me sir, may I talk to you?

B: Sure, come on in. What can I do for you?

A: Well sir, as you know, I have been an employee of this prestigious firm for over ten years.

B: Yes.

A: I won’t beat around the bush. Sir, I would like a raise. I currently have four companies after me and so I decided to talk to you first.

B: A raise? I would love to give you a raise, but this is just not the right time.

A: I understand your position, and I know that the current economic downturn has had a negative impact

on sales, but you must also take into consideration my hard work, pro-activeness and loyalty to this company for over a decade.

B: Taking into account these factors, and considering I don’t want to start a brain drain, I’m willing to offer you a ten percent raise and an extra five days of vacation time. How does that sound?

A: Great! It’s a deal! Thank you, sir!

B: Before you go, just out of curiosity, what companies were after you?

A: Oh, the Electric Company, Gas Company, Water Company and the Mortgage Company!

Tuesday, August 24, 2010

If Those Other Emergencies Had Not Happened, I would Be Prepared for This One

Needless to say my emergency fund is tapped out.

With these emergencies behind me and new things to pop up, I need to start building my emergency fund back up. The rule of thumb I try to follow is to build an emergency fund of $1,000 before worrying about saving 3-6 months worth of expenses. This allows you to get into the swing of saving without being overwhelmed with saving $5,000 or more. Saving this money isn’t as hard as you might think.

There are a lot of tips to quickly saving for emergencies, some are common sense and some will make you rethink how you are spending your money.

• Cook all but one meal per week. Cooking is a good way to save a good bit of money every week. We don’t often realize how much money we spend eating out.

• Limit going out. Alcohol is expensive. Have get togethers at your place. Invite your friends, make it BYOB, and enjoy.

• Clothes, gadgets, and subscriptions. Cut back and save for things. Avoid impulse buys.

• Sell your stuff. Ebay and Craigslist aren’t just for buying stuff. List things that you don’t use or wear. If you haven’t worn it in the last 12 months, chances are you won’t wear it in the next 12 months. Same goes for books, movies, pretty much anything.

• Get a second job. Not always fun but an easy way to make some extra cash to build an emergency fund or to pay down debt.

• Get online. There is tons of money to be made online. Take something you love and start writing a blog about it. You can make money from advertisements, affiliate marketing, and eBooks. MD over at Studenomics made $1200 in March 2010 just from writing an eBook about his lifestyle and how others could do the same. Another cool online money making device is online marketing surveys. I do Pinecone Research (you have to wait for them to open registration. When it opens again I will post. You get paid $3 a survey, doesn’t seem like a lot but it adds up.) I also do e-Rewards (you take marketing surveys and build up a balance. Each survey is worth different amounts. You can link this account to you UPromise account for student loans. In a year I have accumulated $100. Again not much but it’s something.) There are many more of these survey websites out there; when I come across a good list again I will post it.

• Save $5 per day. Start eliminating these small desires or bring them from home instead of buying them on the way (coffee, that morning bagel, bottled water…) and save $5 a day. After 6 months, you could have about $900 extra put into savings.

• Question every penny you spend. Hold yourself accountable for your purchases. The little things add up.

• Put adsense on your website. Adsense is the fastest way to make money from your website. And if you don’t have a website, you can always start one.

• Post your resume. Wherever you are a writer, blogger, designer, programmer, etc, there are many websites like elance.com where you can find some part time work. Give it a try and post your resume.

• Write for ehow.com. Ehow is a how to

articles directory. You can write as many articles as you want and receive money when someone visits your articles and clicks the ads.

• Teach English via skype. If you are a native speaker, you may find someone who’s willing to pay you for simply having some conversation over skype. Just do a quick search on google to get an idea.

• Post your photos on istockphoto. Stock photo websites like istockphoto can bring you a lot of money. Some people are even making a high 6 figures income from it.

• Coach or teach others. Do a list of your top skills (hint: you have many) and teach them to other people. If you are good at something, there’s always someone else that wants to learn it, so take the opportunity to make some money and to learn something new at the same time.

• Sell your own product. If you have a hobby where you can make something, sell it.

• Do baby sitting. If hanging around with a baby is no problem for you, consider doing baby sitting.

• Offer to do some errands for your neighborhoods. Everyone’s busy, but you are can alleviate their days by doing some errands for them like going to the groceries store in the afternoon.

• If you know a foreign language, offer to do translations. There are many companies who would benefit from a native speaker for doing some translations. Often you can get a serious work from this, so do some research to see what’s available.

• Make money with clickbank.com. Create an account at clickbank.com and find a genuine product to promote through your website, or build a dedicated website if you are good with SEO (you can always learn).

• Petsitting. Offer to take care of your neighborhood pets when they go on vacation, or take their dogs for a walk while they are at work.

• Offer computer assistance. You may be surprised by how many people don’t know how to do basic stuff like setting up an email account or uploading a video on youtube. Offer them your help for a small fee.

• Build websites for small companies. You don’t have to be a programmer to make websites. There are excellent content managers and templates you can buy for making small websites. You can also outsource the complete process of course.

• Write a book. This is huge, but it may be worth it. Write about something you really care about, and then knock every door until you find some publisher who’s willing to publish your work.

• Start a blog. If you have something to say, start a blog. It might take a while before you start to see some serious money, but they’ll eventually come if you do things right.

• Sell a blog. Of course you can also sell a blog. Blogs are sold every day and many people make and sell blogs as a part of their day job.

• Work in a bar. If you like clubs, bar and night life, consider working in one of it in the weekend.

• Sell your gold. Maybe you have an old bracelet that you really have never used. That could be a quick way to make some bucks.

• Gardening. If you are not afraid of doing manual work, you could take care of someone else’s garden.

• Clean house. If you don’t like gardening, you can always clean homes.

• Cook for others. Your job would be to buy, cook and freeze food for others to enjoy. Only do this if you are a good cook.

• Direct selling. Many companies will be more than happy to give you part of their revenues if you refer to them new clients. You could give presentations of a product to your friends or go door to door.

• Personal shopper. If you have good taste and you love shopping, there’s nothing better than being a personal shopper.

• Deliver pizza. This is an old school way of making money. Be sure you are not afraid of driving fast if you want to do it.

• Waiter. Try to get a part time job as a waiter and you’ll likely get nice tips from customers if you are working in a nice place.

• Rewrite ads. If your grammar is good, take a look at ebay ads and if you notice one that sucks, offer its owner a rewrite for a 1% or 2% fee. Only target big items of course.

• Drive people to the airport or station. Same as before, there’s always someone who needs a drive to the airport.

• Take a look at craiglist for job ideas. There’s always some odd job you could do on craiglist. Take a look at your city’s listings every once in a while and catch every opportunity you can.

• Have a garage sale. If you are moving to a new house, do a garage sale to get rid of your old stuff.

• Sell umbrellas on rainy days. Be the right man in the right place at the right moment ;)

• Tutoring. If you are good at math, English or something else, you can tutor kids during weekends or summers.

• Ask for it. If what you really want is more money, perhaps you could ask for a raise?

See there are a lot of things you can do to earn extra money to build your emergency fund, or even pay off debt.

You never know when an emergency will come up so it’s better to be prepared than have to put yourself further in debt because you have no money set aside.

Once I am able to build up my emergency fund I will be prepared for the next time my dog decides to see if he can fly, I will have money to pay for the ER visit. And anything else that pops up.

Wednesday, August 18, 2010

What Would You Do?

• You have to give more than you spend.

• You have to save more than you give.

• You are allowed only one frivolous purchase.

• You have to buy property.

What would I do?

I would give ¼ to charities (battered women’s shelters, education, and homeless). Give my CLOSE friends and family $20,000 a piece.

Buy an affordable home.

Buy myself a 1965 Mustang. (frivolous purchase)

Pay off my debt. Pay for my wedding. Fully fund my retirement every year. Invest. Travel/clothing-shoes/fun. (all under the spend category)

I would quit my job and do something I love like work with kids since I wouldn’t have debt to keep me at my job.

So, what would you do?

Tuesday, August 17, 2010

Reader Success: CB

This morning I was having a conversation with a good friend about vacations and such when she began telling me how before talking to me and reading my blog she hadn’t realized she could do more of the things she has always wished to do; in her case travel.

Here is what she had to say:

CB: “LOL well I’m planning a couple! One is the cruise you know about that one. Then there is…Paris!!!! I think I can do Paris spring 2012. I have a plan I’m working on, I’m paying down debt and planning more trips. I have always wanted to see the world and I can if I plan right. I have limited my budget on material things because damn it I’m over 25 and I’m not a Barbie! I don’t need Chanel this and that it will come in due time. So no more weekly hair sessions at the salon. It’s every other week and only one bottle of perfume every four months because it’s 80 dollars a bottle and while I like smelling good y spend that much? Not going to the hair salon every week is saving me 80 – 100 dollars a month! I’d rather be 35 with a great retirement plan than 40 still living in an apartment driving a Benz and carrying a Hermes bag! LOL 2013 Dubai! It’s expensive but I planned it according to what I make now and I know it’s possible! Just feeling accomplished!!!!!”

Me: “I like to hear people our age thinking about the future! People often fail to realize that if you plan, budget, and cut out things you don’t need or cut back...you can do much more with life.”

CB: “Well honestly honey I was inspired by you! I have always been a good planner but never really thought about traveling because I thought I couldn’t afford it. I started reading your blogs and thinking about my future it all made sense. Plan accordingly and you shall have! Things of good taste and quality never go out of style (unless it has shoulder pads! Lol) Taking the time to buy quality items that will get more than one wear are key. I may want this bag but if it’s 250 and I only have 350 to my name y buy it? Oh because I can live off of a 100 dollars for a week or two. If that’s the case why not wait until you have 600 buy the 250 bag; save the extra 250 and still live off 100. I’m not cutting out the stuff that makes me feel pretty I don’t have a buy a new outfit every time I get paid or new shoes or even go out. I can pick up pieces of items and by the end of the month have an entire outfit. Learn how to tweak my own hair to get me through until I can go the salon again and just because I brought these shoes last year doesn’t mean they are not cute. I’m just changing my mindset because I want so much more out of life you know?”

Me: “awww...that makes me soooo happy. I really needed to hear that. it’s not about going without, it’s about doing some planning to make sure u have everything. I really want to help ppl with their money but it’s so hard because people r so ashamed (my last blog) and don’t seek help because they don’t want people to know. I think it’s so important to teach people our age about money and help them get started on the right track. but what you said makes me soooooo happy!”

CB: “Everyone has different issues and yes none of us like to admit we are not capitalizing on our money and investments. I seriously was throwing money away because I didn’t have anywhere to spend it. So instead of saving it I was buy 300 sunshades like I had lost my damn mind! LOL It wasn’t that I was in debt I was trying to make my money work for me and my future and what I want to do. Then not anticipating a raise or pay increase and living off of what I know I am making helps too. I am looking for homes under the 190,000 mark because I can afford it. Scratch the 10,000 dollar down payment, I want 37,500 now and if it takes me two or three years so be it. I want to finish my degree and move somewhere that will allow me to get the house I want and a salary I’m comfortable with. I revamped my 401 k and pension plans to allow me to gain more money. I finally invested more into the stock ownership plan and while I’m not making as much who misses 10 dollars a paycheck when you know it’s going to help you later? Last year my stock earnings gave me $213.66 and I was only investing 5.00 a month. My company will match up to 10.00 dollars your first 5 years invested; 15.00 dollars 10 years invested; 20.00 20 years invested and 30.00 dollars every year after. So now imagine I do 20.00 monthly with a match of 10.00 that’s 30 dollars a month over the course of a year; that’s 360 dollars base every year before interest and dividends. I’m learning… thanks to you!”

Financial independence can be done and you don’t have to totally sacrifice your wants and needs to achieve it!

Monday, August 16, 2010

Fear and Your Money

Money is one of the things in life than can bring anxiety to a new level, no matter how much or how little we have. Those with it are afraid to lose it and those without it are afraid because they don’t have enough. No matter what else is happening in life bills need to be paid and food needs to be bought. Neither of these can be accomplished without money.

What we fail to realize is that we are not the only person on Earth that is in debt. We feel ashamed and guilty because we feel we have failed, especially at such a young age. The first step in getting over this fear of money and debt is to realize you are not alone. You are not the only one.

Being embarrassed is ok; just don’t shut down because of the embarrassment. Get over this fear by taking the time to understand why and how you got into debt. For some the reason is illness or job loss and for others spending is the main reason. Once you understand where the debt came from you can begin to tackle it. Understand this is a long, hard road to financial independence. (I say financial independence a lot, what do I mean? Financial independence to me is being out of debt; outside of a mortgage and large student loans that will be paid down in time; fully funding retirement fund or 2 and being able to use your money for your own use, not to pay to others).

The road to being financially independent is another thing we fear. Compared to getting out of debt, admitting that we have a problem financially is the hardest part of actually getting out of debt. We have to admit that we haven’t been doing something right with our money and that we need help. Getting out of debt includes some scary things like tracking our money, budgeting, finding ways to earn extra money, dealing with creditors, and saving for things we want instead of getting them right away. all of these things aren’t fun, or we would be doing them already.

I have developed a series of stages that we go through in our debt journeys, each stages takes as long as it takes before we can move onto the next. The steps are much like the 12 steps an addict goes through for recovery only shorter, because, well addiction is a big reason people are in debt (not the only reason).

• Stage 1 – understanding and coming to terms with our debt. Here is where we admit to ourselves that we are in debt, being understanding why we are in debt, and seek some type of help in order to deal with the debt. In this stage we learn a lot about finances by reading material and talking to people in the know.

• Stage 2 – putting everything we learned in stage one into action is next. We make a budget we can live with. Start to live frugally and learn to save for things we want. We understand our wants and our needs and Set and pursue our financial goals.

• Stage 3 – once we are able to comfortably adjust to this new lifestyle, we begin to see progress. Don’t let this progress trick you into falling into old, bad habits. There is still work to do, keep watching that debt disappear!

• Stage 4 – after getting out from under debt comes being financially independent. Our money is truly ours. We have no debt. No credit card debt because we have become accustomed to paying the balance in full every month. No auto debt because it has either been paid off or you paid cash for your vehicle. No other miscellaneous debt. You have an emergency fund you are comfortable with. You fully fund your retirement each year and can retire when you are ready, not when someone else tells you that you are ready. You have savings for your children’s college funds. You are able to take vacations without worry.

Doesn’t this all sound great? It is all possible! All because you took the first step and overcame your fear of money and debt. Don’t be afraid to ask for help and don’t be afraid of the journey towards financial independence.

Thursday, August 12, 2010

NYP Celebrates the Journey of the Youth Olympic Flame

On 7 August 2010, NYP was the first of the six sites to host the community celebrations as part of the Journey of the Youth Olympic Flame (JYOF).

More than 5,000 students, staff and residents were at the NYP atrium to celebrate this occasion. The Guest-of-Honour was Prime Minister Lee Hsien Loong.

Our guests were treated to a number of exciting performances. These included percussion performances, song performances, fusion cultural and hip hop dances. There was also a heart-stopping abseiling act by three students from NYP Adventure Club.

“When I was first selected to do abseiling upside down, my first reaction was ‘Are you kidding?’ But I like challenges and decided to give this a go. So I had been practising three to four times a week to master this. I’m glad everything went smoothly. It was an honour and an once-in-a-lifetime experience to do this for NYP and Singapore," said Year 3, Diploma in Space & Interior Design student Muhammad Haidar Bin Tayib.

The highlight of the evening was the lighting of the YOG flame. Six NYP torch bearers were specially selected to be part of this relay. The final torchbearer, Nada Binte Ahmad Khalid, a second-year Diploma in Physiotherapy student, joined the Prime Minister on stage for the lighting of the cauldron.

“It was such an honour to be the final torch bearer. When I was bringing the torch to the atrium, I felt very touched to see so many NYP students and staff cheering me on. I was so overwhelmed that I wanted to cry. It makes me very proud to be an NYP student, and to be able to play my part in this special occasion,” she said.

Monday, August 9, 2010

The Number that Determines It ALL: Your Credit Score

Credit scores are made up of several aspects:

1. Payment history -- about 35 percent. Think those late payments and overdrafts on your bank account really don’t matter? Think again, they can stay with you for years. These dings can negatively affect your credit score and make you look a lot worse than is really the case.

2. Amount owed -- about 30 percent. This means everything you owe, to everyone. Remember the debt-to-credit ratio I talked about before? Don’t close accounts and make sure to pay off debt.

3. Length of history -- about 15 percent. The longer your credit has been around, the better. The longer your credit is good, the better.

4. New credit -- about 10 percent. Applying for credit too much or too often is bad for your credit. Apparently, this makes you look desperate. If you need credit, shop around for a short period (30 days) and don’t overdo it.

5. Miscellaneous-- about 10 percent. This is a mix of everything credit related.

Credit scores range from 300 to 850, anything under 620 is considered sub-prime. Sub-prime is the act of financing someone who has “blemished credit, low income, or limited documentation” and means your interest rate will be MUCH higher than if you had a higher score. The score actually comes from a combination of the 3 reporting credit agencies: TransUnion, Experian, and Equifax. You can, and should, check your credit reports for free once a year by going to annualreditreport.com to see what exactly is on your credit reports. What is on your credit reports determines how high or low your credit report will be.

Your credit report shows your personal information, credit cards –balances and credit limits, all loans, any accounts in default, and anyone who has checked your credit recently. (One of the first steps to getting out of debt is getting a copy for your credit reports.)

Once you have a copy of your credit reports you know who and how much you owe. You can begin contacting and paying off your debts. If you have debts or defaults you can either phone the agency or write a letter. Make sure to state that when the debt is completed you want it removed from ALL credit bureaus. Here is a sample:

Your name

Address

City, State and Zip

Today’s date

Creditor Name

Address

City, State and Zip

Re: Your Name

Creditor’s Account Number

Your Social Security Number

I (name) wish to settle the outstanding debt with (creditor). (Explain why you’ve fallen into debt.) I strongly wish to pay back this debt.

Currently, the outstanding debt balance is (dollar amount). I am willing and able to settle this amount for (amount you can afford to pay). As part of this settlement I am making the following requests:

My account will be shown paid in full.

Any litigation is dropped.

All negative listings will be deleted from the three credit bureaus below.

Equifax

Experian

TransUnion

Upon acceptance of this letter (creditor name) agrees to the terms and settlement conditions and I (name) will send an overnight money order in the amount of (settlement amount) paid to (creditor name).

(Creditor name) agrees to forward this letter to the three credit bureaus listed so negative listings may be deleted.

(Print Your Name) (Print Date)

(Sign your name)

You can either agree to pay in full or set up a payment plan. Something many don’t know is once your debt is sold to a collection agency you can most likely settle for a fraction of what you owe. You can do this because the original agency basically writes off your debt and sells them to the collection agency for pennies on the dollar. This is how collection agencies make money, off of you. By convincing you to pay the full debt, they make a profit on the difference. Try to negotiate. It couldn’t hurt.

With each debt or default you settle your credit score will raise, overtime. To quickly raise your score when you pay off items in default, make sure you get a letter from the agency stating you are free from this obligation. Once you have this letter send a copy to each of the credit bureaus to have it removed from your reports.

Your credit score will begin rising and you will be clawing your way out of debt. This can often be a slow process, so try to stick with it.

If you need help with this process, I will be glad to help.

Friday, August 6, 2010

What is your financial bad habit?

Clearly, I know better and sacrificing all the time is no fun, but impulse buys can be dangerous. Usually I am great with money and don’t let my wants control my actions but I am not perfect. I have a secret too, sometimes I buy expensive things I don’t need on… dun dun dun… credit. How could I be so swayed by the allure of things? Simple, buying stuff we want is fun and makes us feel better.

Along with buying things I clearly don’t need, I usually have terrible “buyer’s remorse”. I feel so bad after buying stuff, even things that I need, that I can’t enjoy what I bought. Usually as soon as I walk out of the store it hits me. But, I never take anything back. I just go home and sulk...with my new stuff.

I know I am not the only one who experiences this need for instant gratification. It’s part of who we are. We want what we want, when we want it. Sadly, this often leaves us paying for our impulsive decisions financially.

Growing up, my mom would ask me if the item I just had to have was a want, a need, or a need-to-want. Most often, it was a need-to-want because I wanted whatever it was so bad that I convinced myself that I needed it. Obviously, I never overcame this need-to-want syndrome but as I have gotten older, and hopefully wiser, I have developed some ways to trick myself into either waiting to buying something or not buying it at all. It hasn’t been an easy road to recovery, but I think I’m on the right track.

Here’s how to beat the Need-To-Wants:

• Each month I set aside a certain amount of money, let’s say $200, that I can spend anyway I want. Instead of rushing out to spend the money right away, I keep the money in a separate account and let it add up. If I have something in mind that I know I will be wanting in the future, I simply save up the money. For instance, I love sneakers, more specifically Air Jordan’s, and this Christmas the Retro Air Jordan 11 “Cool Grey” is coming out. So, I’m saving up for those. (If anyone wants to buy them for me so I can save my money to pick up some other sneakers, feel free.) No regret, no impulse buy, no problem. And I will have my shoes. The money is set aside for the purpose of buying those exact shoes. Since the money is set aside I won’t be taking money from something else more important.

I do this for vacations, car repairs, big purchases or holidays. You can set aside money for anything really, just remember to save up to keep the impulse buys away.

• Another method to avoid the impulse buy is to set a time period that must pass before I can buy something over, say, $150. Personally, my time period is 2 weeks and even then I debate whether I really need the item or not. Most times, the time period allows me to realize I don’t need another gaming system or whatever it may be.

This doesn’t mean if something is $140 that you shouldn’t take the time to think over the purchase. Every purchase should be given time to marinate. Think of it this way…the more it costs the longer the marinating period should be.

Now say, its Christmas time and I just learned some shoes I want are coming out and I have already spent all my money on presents for everyone else. I know the shoes will be anywhere from $175 -$200 and will be around longer than just Christmas time. So I have to wait the 2 weeks. If I still want the shoes after the time passes, I let myself get them. By this time I should have set aside some if not all of the money to buy them. Again, the money is there and no buyers remorse.

Making myself wait allows me to think over the purchase and decide if I really need it. In this case, YES I DO! Hopefully, I have thought over the purchase and am able to make the decision based on logic rather than impulse.

• I have a special rule for clothing. If the item is like something I already have or have several of, I pass on the item. I don’t need a closet full of the same things just because I like them. I try to focus on the essentials, which for me are white tees, t-shirts, jeans, and shorts. Other than that it has to be something to set off what I already have or I don’t buy it.

• The most important tip I have for impulse buys is: DO NOT BUY IMPLUSE BUYS ON CREDIT. If you do not have the money to buy something, chances are you don’t need it.

Take control of your spending habits, learn to distinguish between your wants and needs, and save for what you want. Life doesn’t have to be all about saving, saving, and more saving. You can have the things you want too.

So, what’s your financial bad habit?

Wednesday, August 4, 2010

9 Ways to Master Your Money

1. Know where your money goes

The first step in mastering your money is to know where your money goes. An easy way to do this is to keep a small notebook that you carry with you to record every purchase. Every penny. If the notebook idea isn’t for you there are tools you can use such as Quicken Online and Mint or Software such as Quicken or Microsoft Money.

Tracking every penny allows you to know the places you can cut back and holes in your finances. This is always hard to get in the habit of doing, so find a method you are comfortable with and stick to it. Try for a month and be amazed at all the wasteful spending you aren’t even aware of.

2. Budget…Budget…Budget

Now that you know where your money is going, make a budget. Something you may not know is 55% of Millionaires and use budgets religiously, this according to Millionaire Next Door. Budgeting allows you to plan for monthly expenses, as well as vacations, car expenses, home repairs, and rainy days.

There are many types of budgets out there from the 60% budget, the 3 step budget, the balanced money formula, even a type of budget for those who can’t budget – the spender’s budget.

The 60% budget:

• 60% to Committed Expenses such as taxes, clothing, basic living expenses, insurance, charity (including tithe), and regular bills (including things like cable).

• 10% to Retirement.

• 10% to Irregular Expenses such as vacations, major repair bills, new appliances, etc.

• 10% to Long-Term Savings/Debt — money set aside for car purchases, home renovations, or to pay down substantial debt loads.

• 10% for Fun Money to be used for dining out, hobbies, indulgences, etc.

The 3 step:

• Destroy all your credit cards. – I don’t believe in destroying the credit cards but learning how to use them safely.

• Invest 20% of all that you earn. And never touch it.

• Live on the remaining 80%, no matter what.

The Balanced Money Formula:

• Needs are things you must pay no matter what: housing, food, utilities, transportation costs, insurance.

• Wants are everything else: cable television, restaurant meals, concert tickets, comic books, clothing beyond the basics, etc.

• Saving comes last in this plan. Everything left after you take care of Wants and Needs is set aside for the future. Debt repayment comes from this too.

The budget for those who can’t budget : (This is more of a plan than a budget)

• Project income. How much do you bring in every month? Will you receive any windfalls soon?

• List fixed expenses. Write down those things for which you must pay every month: cable, telephone, gas, electricity, etc.

• List your debts. Make a list of everything and everyone you owe

• Plan ahead. Do you have any large expenses on the horizon?

3. Make your money work for you

Exactly how it sounds, make your money work for you. Online banks often give higher interest rates for savings and checking accounts than customary banks. By placing your money in these accounts you are earning money on the money you already have without doing much. Also, using rewards credit cards is another way to make your money work for you. Just use them responsibly and pay your balance each month. Rewards checking accounts have also begun being popular, here is a list to help you find the right one.

4. Save for Emergencies

Emergency funds help to ensure you are always prepared for whatever life throws at you, as best you can. It’s pretty easy to build your emergency fund using an online bank like ING. Using the online bank allows you to set up automatic deposits each month so you don’t have to even think about it. Simple. Start with a goal to build $1000 in your emergency fund before you really begin attacking your debt. You can easily do this by automatically transferring $50-$100 (whatever is comfortable for you) into the account and before you know it…poof…you have an emergency fund.

5. Get out of debt

This is the step many people try to do first, before they take the time to realize and correct why they are in debt. One way to pay down debt is what Dave Ramsey in his book The Total Money Makeover calls the Snowball Method. This method is very psychologically gratifying because it allows you to build momentum in your debt fight.

• Order your debts from lowest balance to highest balance.

• Designate a certain amount of money to pay toward debts each month.

• Pay the minimum payment on all debts except the one with the lowest balance.

• Throw every other penny at the debt with the lowest balance.

• When that debt is gone, don’t alter the monthly amount used to pay debts, but throw all you can at the debt with the next-lowest balance.

This allows you to feel as if you are making progress and helps to keep you in the game.

6. Save for the future

Compound interest is your best friend. Put aside a little now and its worth a lot more later. 401k’s and Roth IRA’s are a great way to save for the future.

7. Automate your finances

Go paperless. Make payments automatically. Automate your savings. Link your checking account to a savings account for overdraft protection. Easy.

8. Earn more money

Some techniques to earn more:

• Ask for a raise.

• Switch employers.

• Take a second job.

• Use your hobbies.

• Volunteer for medical research

• Sell things.

9. Financial Education

Read, read , read about finance. Find financial blogs that meet your interest, read books, talk to anyone who may know something you don’t.

Know that you know how and what to do to take control of your money, do it.

Monday, August 2, 2010

Understanding How Credit Scores Work

ING had a quiz this morning to see which activities people think will negatively affect their credit score. Let’s see how you do:

• A. Opening a new checking account

• B. Applying for a new credit card

• C. Bouncing a check/paying fee for insufficient funds

• D. Charging high amounts/paying bill in full each month

• E. Lowering your credit limit

• F. Closing old credit card accounts

• G. Paying an ATM fee

• H. Having a high credit limit

• I. Never having a credit card

• J. Keeping old, inactive accounts open

• K. Accessing your credit report

• L. Having a short history of credit

• M. Exceeding a credit limit

• N. Having a lot of debt

• O. Using checking account overdraft protection funds

• P. Paying a mortgage late

• Q. Paying bills late

• R. Checking your credit score

Many of these are activities we often do with no thought or understanding of how they will affect our credit. I often tell people, “It’s the little things that add up.” Let’s look at the answers and look at how and why they affect the credit score.

B. Applying for a new credit card – each time you apply for a new credit card your credit takes a hit. Basically, anytime someone checks your credit, it gets dinged and too many dings in a short period of time can negatively affect your credit. If you have to apply for credit of any type try to space it out (a couple of months) from the last time you had your credit run. This will help you have fewer dings.

E. Lowering your credit limit - lowering your credit limit might seem like a good idea because it leaves you with less credit to mess up, but it’s not. The amount of credit you have is important for building your credit score. Creditors look at something called your “debt to credit ratio” when determining if or how much money to lend you. So if you lower your credit limit, or your limit gets lowered for you, it messes up your debt to credit ratio and makes you look like a bad candidate for lending credit too. Think of it this way, if your limit is $5,000 and your balance is $2,500, your debt to credit ratio is 50%. Now if you lower you limit to $3,000 and your balance is still $2,500 this leaves you with $500 in available credit and totally messes up your debt to credit ratio. Rule of thumb: keep you credit balances below 70% of your balance, the lower the better.

F. Closing old credit card accounts - a part of your credit score is how long you have had credit. The longer you have a card the better for you. The rule of thumb for keeping old cards open is to pay off the balance and only use the card for small purchases every few months. This keeps the card active and keeps it on your credit report. But remember to always pay off the balance, in full.

I. Never having a credit card – this is bad because if you have never had credit, you don’t have a credit history. Lenders see you as high risk and won’t lend you money. It will be hard to get any type of loan if creditors see that you have never had a credit card. Sadly, the older you get the harder it becomes to obtain a credit card. There are options out there. I suggest working with your bank or credit union, since they know you and your money, to help you find the right type of card to help you build credit.

L. Having a short history of credit – this is often referred to as “not having enough credit”. These are usually people who haven’t had a credit card or haven’t had one long. This is also bad because lenders don’t know your credit and payment history and will be very reluctant to lend you their money. The only way around this is to continue to build your credit positively, while keeping the dings away.

M. Exceeding a credit limit – I’m sure this one is pretty obvious. Spending more than you have is bad and makes you look very risky to creditors. Remember the 70% or lower debt to credit ratio and you will be fine.

N. Having a lot of debt – we all know this. A lot of debt is bad. If you have a lot of debt, don’t even think about trying to get credit with the way banks are lending right now. I should say, the way they aren’t lending right now. The debt to credit ratio is not just for credit cards, it’s your overall credit and the more debt you have the worse your debt to credit ratio will be. Develop a plan to significantly lower your debt before trying to obtain a loan.

P. Paying a mortgage late – paying anything late is bad for your credit and makes you high risk to anyone who would potentially loan you money. Each late payment makes you look worse and worse. If you cannot pay your mortgage on time call your lender and try to work a new payment plan out with them.

Q. Paying bills late – same as with your mortgage, if you know you are going to be late, call. The worst that can happen is they say too bad, pay us. On the flip side they might be willing to work with you.

R. Checking your credit score – this wasn’t one of the answers ING gave, but I feel this needs a little explanation. Every year each one of us is able to check our 3 credit reports, for free, from the federal government. While it is good to check your credit reports, checking them too often can be bad. Just like when an outside person checks your credit, you can ding your own credit. There are services that allow you to check it more than once a year, for a fee of course but using the annual free credit report from the government is only allowed once a year.

Gaining control over there things will not only help increase your credit score and open a lot more doors to you, but will take a lot of stress out of your life when it comes to your finances.

Thursday, July 29, 2010

Welcome to the First Days of Your NEW Financial Lives

Financial education should have been as important as the other subjects forced on us in our youth, but for many of us how to control money was never a topic of choice in schools and in our homes. This neglect has left us unprepared and ashamed to ask for help.

Credit cards, auto loans, student loans, living expenses, balancing it all on an income that doesn’t quite meet our financial demands leaves us feeling frustrated and stuck. No one said it would be this hard.

Along the way I have figured some things out, mostly the hard way, and want to pass what I have learned onto others. As a team, we will devise a plan, budget, and dig out from the financial holes we were so unprepared to handle. Like anything in life climbing out from debt isn’t easy, which is why most of us never try, but with a helping hand or an open ear we can do it together.

Don’t put off today what will help you live easy tomorrow. I am here to help! Contact me when you are ready to keep more of your money in your own pockets!

Tuesday, July 27, 2010

Making the Right Choice: Preparatory Workshop for NYP Top Students

Diploma in Industrial Design

What are your strengths and weaknesses? How can you improve those weaknesses and leverage on your strengths, in order to secure scholarships and jobs in the future? Those were some of the questions posed to some 100 top NYP students who attended a one day “Interview, Scholarship & Career Preparatory Workshop” held on 22 June 2010.

In the morning, the students were introduced to a framework for career planning and guided through several exploratory and self-discovery exercises. This helps them to have a better understanding of themselves and learn more about their skills, strengths and weaknesses. They discussed career planning and completed worksheets on skills investigation, values assessment, and career interests.

“We encourage the students to know more about themselves, what makes them unique, and to know how to promote their positive traits effectively,” said Ms DJ, one of the coaches from Brightsparks.

After lunch, the participants worked in groups and practised role playing in mock panel interviews, where they learnt how to ace an interview.

Here’s what two of the participants had to say:

“I was able to explore and learn more about my interests and ambitions. I also picked up effective interviewing skills to ‘sell’ myself such as how best to presenting myself during an interview. These include,: speaking in a coherent manner, proper posture, facial expressions, tone of voice and language used.”

Malcom Chan

Year-3 Diploma in Fund Management and Administration student

“I will apply the skills I have learnt by creating a ‘sales story’ about myself, as taught in this workshop. I will focus on my leadership skills and the measurable achievements that I’ve attained. I will also read up on the company I’m applying to, and to anticipate the possible interview questions. I learnt that it is important to stand out from others during an interview and to provide evidence to support the personal qualities that you have stated.”

Nair Zeus Jaren

Year-3, Diploma in Molecular Biotechnology

Thursday, July 22, 2010

New Sponsorship Scheme from NCSS for NYP Students

They are young, earnest, and enthusiastic. They are also driven by a strong desire to pick up professional skills to help others.

NYP’s first batch of 26 students from the Diploma in Social Sciences (Social Work) course started term since April 2010. This new course aims to train Social Work Associates to meet the increasing manpower needs of the social service and healthcare sectors in Singapore.

The students in this course recently received a boost with a new sponsorship scheme called the Social Work Associate Training Sponsorship. This new sponsorship has been introduced by the National Council of Social Service (NCSS), with the support of the Ministry for Community Development, Youth and Sports.

Ten students have been offered this sponsorship, which covers tuition fees, other compulsory fees and an allowance for books and reference materials for their three years of study. The students received their sponsorships from Ms Ang Bee Lian, CEO of NCSS during a ceremony on 20 July 2010.

Many congrats to our students!

Tuesday, July 20, 2010

Braving the Cold in Hainan, China

A sudden drop in temperature to below 10 degrees Celsius in Hainan sent two groups of students and their lecturers scrambling for warm clothing.

“We had expected similar weather to Singapore’s, so we were not prepared for the sudden drop in temperature. The first thing we did was to buy warm clothing,” recalled School of Information Technology lecturer Dr Alan Ang.

Dr Ang was leading a group of NYP students on an Overseas Community Service project in Hainan, China last March together with School of Interactive & Digital Media (SIDM)Lecturer Wendy Tan.

Another group of students were led by SIDM lecturer Clyda Puah and School of Engineering (Manufacturing)lecturer Charlie Tan.

Preparation for the 17-day trip took about six months. It included recruitment, first aid training, as well as bonding sessions to foster team spirit and camaraderie among the student volunteers.

During the trip, the main tasks of the two groups were: the teaching English and Arts & Crafts at a primary school, the painting of the school, as well as painting an old folks home.

The dreary and cold weather in Hainan proved a challenge but the team persevered to complete the tasks.

“We wanted to paint 12 rooms in the three-storey school building but due to the weather, the paint took a longer time to dry. Furthermore, our movements were slower due to the cold weather. Nevertheless, we did our best. The students divided themselves into three groups: the ‘sander’, ‘painter’ and ‘lacquer’ groups. This

specialisation helped us to complete the task more efficiently, without compromising quality. The sense of achievement when all tasks were completed was our greatest fulfilment,” said Dr Ang.

Project Reading in Chiang Rai, Thailand

A group of 17 School of Health Sciences (SHS)students spent a meaningful two weeks of their March term break doing community service in Wiang Kaen, a district in Chiang Rai, Thailand. The project was led by SHS lecturer Dr Bala S. Rajaratnam.

“We worked with the Lions Club of Singapore, Somerset to secure story books and textbooks from their outreach program Project Reading mms. We also contacted the Singapore-Thai Chamber of Commerce to identify two deserving schools which would benefit from the project. Besides sorting the books, the students also created skits to excite the children to learn English. The skits were even tested with children at the NYP child care centre. The preparation took about three months,” said Dr Bala.

The students taught English skills to children below the age of 12 at the the Panghud Sahasart School and Koon Kuat Pittiya School. They also equipped and furnished three libraries at the schools with some 2,000 donated books, complete with a cataloging system for the loan of books.

In addition, the team also educated children from the nearby villages on the importance of personal hygiene and basic first-aid.

According to Dr Bala, there were some minor hiccups along the way. However, the excited looks of the children’s faces made it all the worthwhile.

He said: “The challenge was to be able to think and react on your feet, as what we had planned in Singapore changed significantly when we were at Wiengkaen. For example, we faced communications problems travelling in the hill-tops location. We overcome these by identifying four Thai students who were good in their English to support the project.”